Big changes are coming to Australia’s anti-money laundering laws, and if you’re in law, real estate, accounting, or other professional services, this affects you. The new AML/CTF Rules 2025 are part of AUSTRAC’s reform rollout, and they’re designed to tighten up how businesses handle financial crime risk.

Here’s the short version.

From 1 July 2026, a new group of businesses (called Tranche 2 entities) will be required to follow AUSTRAC’s rules. This includes:

These businesses will now be considered reporting entities, meaning they’ll need to register with AUSTRAC and follow a set of compliance obligations.

Once the rules kick in, Tranche 2 entities will need to:

There are also options for businesses to form reporting groups, which lets multiple firms share one AML program under a lead entity. This can reduce duplication and make compliance more manageable.

If you’re running a business that deals with property, trust accounts, or financial transactions, these rules are not optional. Non-compliance can lead to serious penalties, reputational damage, and operational disruption.

But here’s the good news: you don’t have to build your compliance framework from scratch.

APLYiD’s software is built to take the stress out of AML obligations. It automates ID verification, streamlines customer due diligence (CDD), and keeps your records audit-ready. Instead of juggling spreadsheets and chasing documents, you get a clean, secure system that does the heavy lifting.

With the 2026 deadline approaching, now’s the time to get ahead. APLYiD helps you stay compliant without drowning your team in admin. It’s a no brainer.

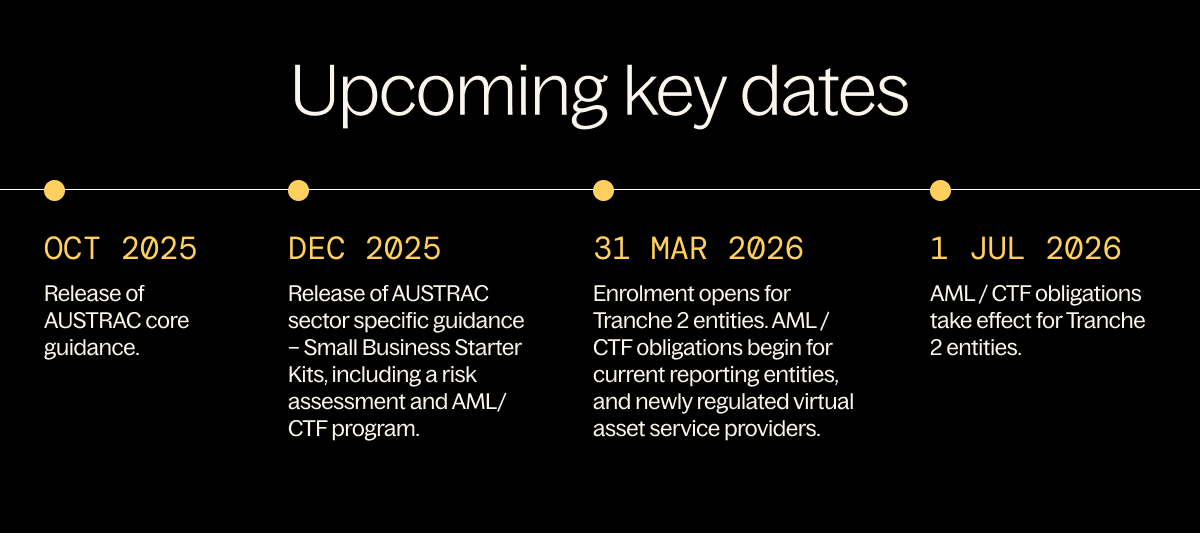

The rules won’t take effect until July 2026, so there’s still time to make sure you’re prepared. We’ve outlined some of the key upcoming dates for you below:

Customer Due Diligence (CDD) is split into two parts:

Depending on the risk level, businesses must apply either:

Yes, but only in limited circumstances. Delayed CDD is allowed if:

If a customer was onboarded before the new rules, they’re considered a pre-commencement customer. You’ll need to monitor them for any changes that increase their risk level. If that happens, you must complete both the initial and ongoing CDD.

Reporting Entities must keep records for 7 years after a relationship ends or a transaction is completed. This includes:

You don’t need to keep copies of ID documents - just a record of what was used (e.g. passport details). The great news is that APLYiD will securely store this information for you for the required timeframe.

You must verify both individuals and legal entities (like companies or trusts). This can be done using:

And, you need to be confident that:

This is where APLYiD comes in. Our software automates this process and cuts out the admin. Keeping your business efficiently compliant and audit ready.

AUSTRAC defines three types of PEPs:

Foreign PEPs are automatically high-risk. Domestic and international PEPs must be assessed individually. For high-risk PEPs, you’ll need to:

All Reporting Entities must run AML/CTF training programs, which should be tailored and delivered regularly. Staff should understand:

Using APLYiD reduces human error. Plus, it can also flag potential fraud risks.

Working with external providers to support CDD can help manage risk and cut down admin for your team. However, you’re still accountable. Before you get started with outsourcing it’s important to check:

You can rest assured that we’re keeping ahead of Tranche 2 reforms to give you total compliance peace of mind with APLYiD.

Keen to try it out? Get started in minutes today.

Starting 1 June 2025, all NZ reporting entities must assess, record and monitor the risk level of new clients.

Read more

If you are a Lawyer, Real Estate Agent, or an Accountant in Australia, you may be wondering what exactly this ‘Tranche 2’ stuff will mean for you in practical terms.

Read more

Press Release: APLYiD Partners with HES Fintech to Enhance Digital Identity Verification Solutions

Read more

It's not hard to scam an agency, and HMRC is on the hunt for AML negligence with £5k fines. Yikes. But there is an easy way to fix this...

Read more

As Valentine's Day approaches, love is undoubtedly in the air, but unfortunately, so is the risk of identity theft within the online dating sphere.

Read more

As we kick off the new year, APLYiD, a leading identity verification company, is navigating through changes in the regulatory landscape.

Read more

In today's fast-changing world of digital security, biometric verification has become a crucial way to authenticate identities.

Read more

What is Enhanced Due Diligence and why is it so important?

Read more

At APLYiD our mission is to end identity fraud and digital crime – that’s why we’ve made the best biometric identity verification software on the planet. But as our technology gets more sophisticated...

Read more

At APLYiD our mission is to end identity fraud and digital crime – that’s why we’ve made the best biometric identity verification software on the planet. But as our technology gets more sophisticated...

Read more

The cost of living crisis, competitive landscape and ongoing war in Ukraine are causing major headaches for the legal industry

Read more

The new 2023 plate change will come in a volatile, ultra-competitive market. Here’s how to win over those harder-to-reach customers

Read more

There are some tiny, fragile signs that the UK Property market is recovering

Read more

The accounting industry is in crisis – but with one simple software tweak it could become a fun, rewarding job once more

Read more

As interest rates continue to rise, so too do abandonment rates. By creating a better customer experience, you can cut those rates while protecting your business from fraud

Read more

The entire accounting industry is changing. For some that means new opportunities for growth and diversification; but for others the change can be traumatic.

Read more

Watch and learn with our pick of the 14 best YouTube channels to follow if you’re serious about cyber security

Read more

Passwords are hacked with ease, and MFAs are not the answer. Isn’t it time the biggest companies protect their clients and workforce with an identity-based perimeter?

Read more

New to KYC? Here’s your at-a-glance guide to the ins and outs of Knowing Your Customer.

Read more

The FCA reports that the UK’s top challenger banks still don’t do enough to eliminate identity theft and cyber fraud – but there’s nothing but silence from the companies that are supposed to be protecting them.

Read more

The next year is going to be a tough one, with fewer car registrations than ever. Follow our tips to make the most of every customer and drive ahead of the competition.

Read more

Some predict a bumper year for consumer finance; other suggest the industry will suffer. Either way recessions can wreak havoc – but here are some ways you can navigate the choppy waters ahead.

Read more

Wherever you look the experts are predicting an annus horribilis for Estate Agents next year. But we’ve unearthed some ways you can beat the property market slump and thrive next year

Read more

Conventional wisdom predicts that legal firms do well in a recession. But that’s not always the case – unless you follow our top five tips for 2023

Read more

Well, 2022 was a bit of a hellscape, wasn’t it? Recessions, political merry-go-rounds, Royal dramas, problematic world cups, and the ever-present ghost at the feast that is Brexit have all left their mark on the

Read more

There are many reasons why elite sports stars can end up poor and homeless. Drug habits, concussions, bad investments, you name it. But Cindy Brown is different.

Read more

The safest, fastest and most trustworthy onboarding process to verify your customer’s identity.

Read more

The best customer onboarding experience… and the best defence against digital fraud.

Read more

Digital-first banks attract customers with no-fee accounts and simple, seamless setups. But their appeal to fraudsters means the more seamless they get, the more dangerous they become.

Read more

The myth persists that identity theft is a relatively harmless, victimless crime aimed mostly at the elderly and vulnerable… but the data doesn’t agree.

Read more

Our complex world and its resultant threats to businesses mean General Counsel and legal firms are getting less sleep than ever. But there’s more to it than just risk: finding the right balance can give in-house

Read more

So much of the world is under threat from scammers, bad actors – and governments that give them shelter. But we can defeat the bad guys if the good guys band together.

Read more

KYC is an important part of protecting yourself – and your customers – from fraud, regulatory breaches and bad actors. Luckily APLYiD makes KYC compliance quick, seamless and effective.

Read more

Imagine returning from a well-earned holiday and putting your key in your front door only to find the locks have been changed…. then a stranger opens the door and asks who you are.

Read more